SMEs have always been the direct victims of adverse economic situations. However, they have adapted their business models to ease the effects as far as possible.

The question here is: how will insurance companies adapt to their SME clients’ developments? How are they going to get the right data before renewals? Today, we will give you some hints on how to speed up these processes thanks to Open Data Analytics. Keep reading!

What is Open Data and how to implement it in insurance?

Open Data is all the information available to the public, mostly on the Internet. From traditional sources such as government databases or scientific articles to less traditional ones such as reviews on social media, websites, news portals, etc…

However, there is a vast amount of data available, and it is hard to find the right source that provides you with accurate, trustable, and easy-to-use information to update your business clients’ data. Here is where Data Analytics comes into play.

There are specialized companies that process all the raw data found on the Internet, filter it, and adapt it to your needs. For example, in the insurance sector, they are the InsurTechs. The ones specialized in Data Analytics, bring insurers the exact information they need for their processes.

How to leverage Open Data in renewals?

Premium renewals have been traditionally an automatic process. However, insurers do not check the changes in each business, leading to losses in time and money.

Once the insurance company has the right software, in the case of renewals, the process can be reduced to less than 5 seconds. With the best InsurTechs, it is possible that only with one click, you get all the missing information, and all the changes of the companies, avoiding checking up on each SME one by one.

Example: case study

With Open Data, checking clients’ data becomes a two-second process. Moreover, the clients’ data is enriched in 93% of SMEs. How? Here we leave you an example:

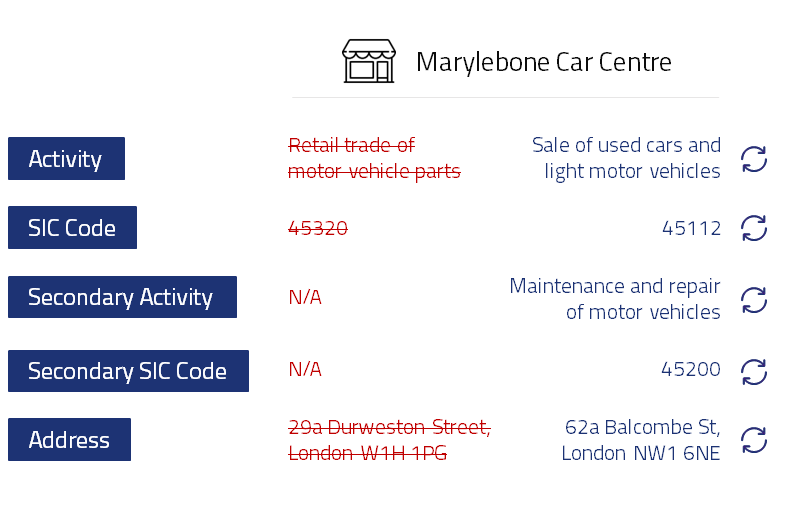

An insurance company has the client “Marylebone Car Centre”. It was registered under the activity “retail trade of motor vehicle parts”. Yet, this business has changed its activity to the ” sale of used cars and light motor vehicles”. For obvious reasons, this place has a higher risk with the new activity, hence, they need wider coverage.

During the analysis, with Open Data, it was also possible to update the SIC Code of the business, find a secondary activity, and reveal an address update.

This way carriers act in time, repricing bigger risks and getting benefits such as 31% premium leakage prevented or a GWP increment of €2.4 Million per year.

Analyzing your clients’ data to see if you need an upgrade is necessary to reduce losses and offer the right products adapted to their necessities. As we saw, Open Data helps us to make these processes more efficient and agile. If you would like to learn more and start renewing premiums with the right data, contact us at wenalyze@wenalyze.com now!